A Special Definition of

"State":

Fraud Confirmed in the

Internal Revenue Code

by

Paul Andrew Mitchell, B.A., M.S.

Private Attorney General (18 U.S.C.

1964)

When we were first exposed

to the possibility of fraud

built into the Internal Revenue Code, we were also

very aware

that proving any such fraud would require a lot

more than

repetition of stories overheard in local bars and

restaurants.

In legal circles,

proving fraud is a burden that falls on the

person making that claim.

In particular, the

word "conspiracy" often occurred during

conversations about the Federal government and its

"Codes",

but we also observed that many interested

Americans

were often allowing their own theories to

"morph" into facts:

Once they had

convinced themselves that a particular

conspiracy did exist, it was almost impossible to change

their minds with contrary facts. This tendency has now

acquired two descriptive labels: confirmation bias

and cognitive dissonance.

Before arriving at any

objective conclusions, we knew

going into such an endeavor that the proof would

need

to be readily available somewhere --

without needing

to resort to magic, mythology, or self-serving

assumptions.

In particular, if

fraud did exist anywhere in Acts of Congress

that were ultimately codified anywhere in the U.S.

Code,

the evidence of such fraud should be visible in

that Code

without too much additional effort beyond the correct

citation,

common sense, and comfortable familiarity with

legalese.

With that stated

objective foremost in our minds,

we set about examining numerous claims that

ended up in U.S. Mail that started to flood our

mail box.

This effort began

before the Internet became popular and,

as such, communications were not nearly as

instantaneous

as they are now.

Visiting a law library required a 2-hour

round trip by automobile; and, as we discovered much later,

some of the most valuable evidence was hidden in

locked archives!

I can remember

acquiring a hard copy of the book

entitled "The Omnibus" by Ralph F.

Whittington

in Houston, Texas. This was an odd title for a

difficult treatise that never made it onto any

"best seller" lists at The New York Times

or anywhere else, for that matter.

In retrospect, it's

now not difficult to understand

why it never received the attention it deserved:

it contained positive proof that Congress had

officially admitted using a special definition of

"State"

in key sections of the Internal Revenue Code.

One of those key

sections contained the legal

definitions which govern that entire Code.

In "The

Federal Zone" we re-published the

Omnibus Acts in

Appendix "B", and you are

encouraged to locate each "special definition"

in this electronic version of that Appendix,

now archived in the Supreme Law Library:

http://supremelaw.org/

After we started to

distribute printed hard copies

of the First Edition of "The Federal

Zone", our mail box

started to fill up even faster with tons of relevant

and

irrelevant documentation.

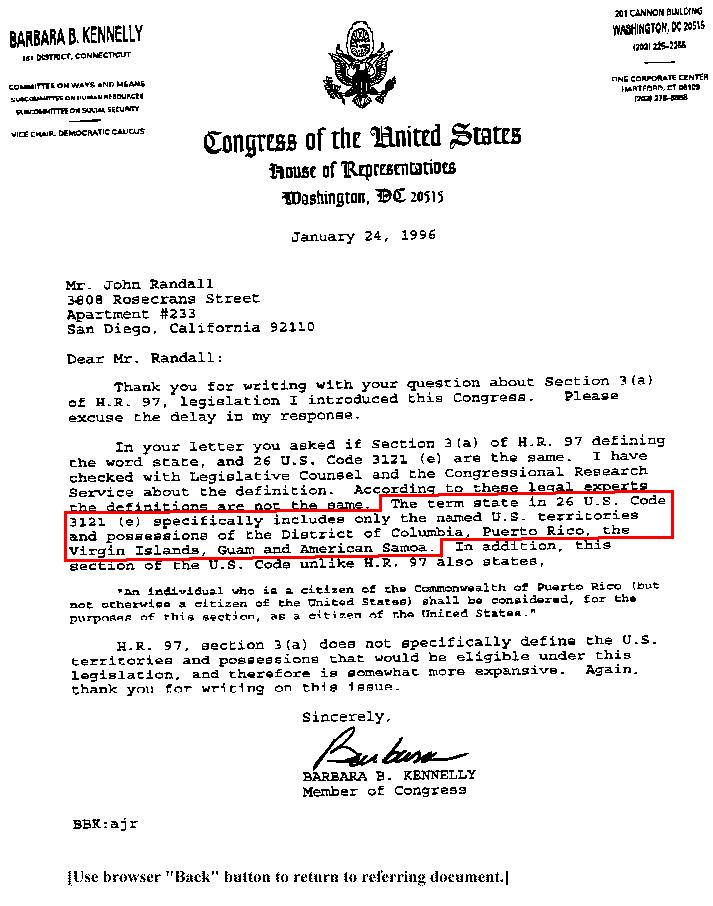

One of the most

satisfying documents we received

was a fax copy of a letter which had been written

by a

U.S. Representative

from Connecticut, in response

to a question asked by a man in San Diego,

California.

That letter ended up

being profoundly accurate

confirmation of the very same point which had

already been well documented in "The

Omnibus":

The special definition

of "State" included ONLY

the District of Columbia, Guam, Virgin Islands,

American Samoa and Puerto Rico.

What made the letter

from that Connecticut Congresswoman

all the more valuable was her admission that she

initially

did not know the answer. So, she referred the question

to government "legal experts" in the

Federal offices of the

Legislative

Counsel and Congressional Research Service.

As such, we now have

it on the authority of "legal experts"

in the Federal government that the legal

definition of "State"

in the Internal Revenue Code does NOT include

any of

the 50 States.

It is true that the

Internal Revenue Code does define "State"

and "United States" differently in

several scattered places.

Nevertheless, the

legal definitions codified at IRC Section 7701(a)

are intended to be used "where not

otherwise distinctly expressed".

To minimize any

lingering doubts about Ralph Whittington's

monumental finding, we now incorporate an electronic

copy

of that Connecticut Congresswoman's important

letter.

http://supremelaw.org/press/

It isn't often that

such monumentally important discoveries

are exposed by a single sheet of paperwork.

Do enjoy yourself by

having a widely popular Internet

and high-speed telecommunications which can now

display that verifiable evidence right before your

eyes.

Seeing is believing, I always say!

Further reading: Electronic 11th Edition of

"The Federal

Zone: Cracking the Code of Internal Revenue":

http://supremelaw.org/

p.s.

The Preface was later expanded after an astute reader

pointed out that there was no liability statute

for subtitle A.

We left our references

to the guilty Regulation in later Editions,

to demonstrate how deliberately deceptive that

Code truly is.

And, of course, we

went the extra mile by serving a proper SUBPOENA

on the Secretary of the Treasury for the missing

statute(s):

http://supremelaw.org/press/

Instead of answering

that proper SUBPOENA, the story we heard

was that O'Neill was fired by G.W. Bush for

objecting to Cabinet meetings

where they were planning to attack Iraq BEFORE

9/11/2001.

# # #